Posted May 02, 2022

ALCHEMIX - THE MOST INNOVATIVE FINANCIAL PROTOCOL OR SCAM

Alchemix - The Most Innovative Financial Protocol or Scam

The idea of credit has been around for a long time, but modern credit as we know it has been with us since1946, and its “inventor” is John Biggins, a banker from Brooklyn.

From that time are credit cards we have today began to exist.

Until recently, loans could only be issued by institutions authorized to do so, banks.

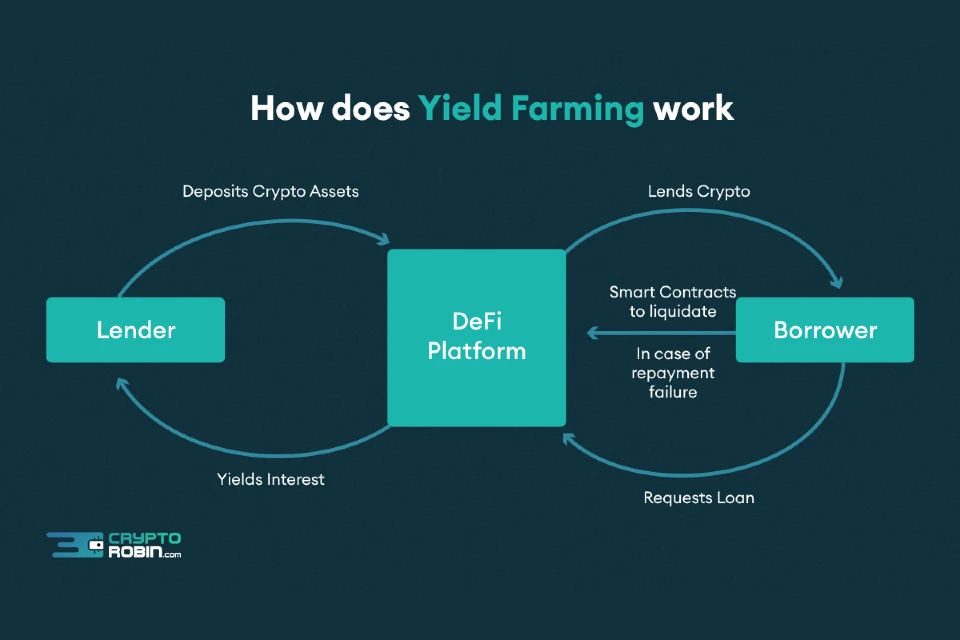

DeFi has brought a revolution in the credit sector so people have been able to use a platform like Aave for several years to take credit in cryptocurrencies with collateral.

Alchemix brings additional innovation, and that is self-repaying loans. It sounds too good to be true, so today we bring more information about this project, its potential and risks.

WHAT IS ALCHEMIX?

In short, it is a DeFi project built on the Ethereum network that allows people to borrow and lend, just like a large number of projects in the crypto space.

What Alchemix singles out is that loans are not necessarily dependent on the borrower repaying the loan.

Instead, the borrower may decide to borrow on some time-frame. It’s like getting a salary in advance from the company you work for.

Your loan repayments are deducted from your future salaries.

The unique features of this project include:

- The ability of borrowers to adjust their loan structure and yield strategy

- Borrow “against” stablecoin with minimal risk of automatic liquidation

- Deposit collateral for which you receive synthetic assets that in turn can be invested or used to provide liquidity in other DeFi protocols.

HOW ALCHEMIX LOANS WORK?

For example, imagine you have deposited $ 100 in a bank, and bank uses them to lend it to someone else at a 1% interest rate.

At the same time, you borrow $ 50 at an interest rate of 1% from the bank using 100 as collateral.

Bank instead of keeping the 1% interest rate to itself, they share with you half of the 1% interest that goes to pay interest on borrowed $ 50.

In the end, the money that is deposited would earn enough to repay the interest, so you don’t have to do it yourself.

Now, that could take a while. Until that happens, you do not have access to the deposited funds.

This is roughly how Alchemix loans work.

To start, pay DAI (stablecoin) via Metamask or one of the Web3 wallets in Alchemix.

You will receive a synthetic token called alUSD, which can be exchanged for DAI in a 1: 1 ratio.

The maximum amount of alUSD you can get is 50% of the amount of the deposited DAI.This means that a DAI worth $ 100 brings you 50 alUSDs.

In other words, the collateralization ratio between DAI and alUSD is 200%.

This ratio remains fairly constant. If, by some accident, the collateralisation is lower, part of the collateral, i.e. the deposited DAI, will be liquidated in order to maintain the ratio.

On the other hand, if the opposite happens, users can extract excess DAI or mint more alUSD.

Alchemix also allows Ether deposits to mint alETH, which can also be used for further investment and yield farming.

There is a global upper limit for minting synthetic versions for both assets to keep constant supply and demand.

ALCHEMIX DAI AND YDAI YIELDS

The deposited DAI is sent to the yDAI vault in yearn.finance to generate a yield in the form of alUSD.

The profits are sent to Transmuter, the only tool in Alchemix that converts alUSD and DAI in a 1: 1 ratio.

AlUSD is automatically converted into DAI, which is then used to repay the loan to him.

A brief look at the yDAI vault shows several yield earning strategies that include Compound Finance, Curve Finance, Balancer, Kashi and AAVE.

DEBT REPAYMENT AT ALCHEMIX

While it’s good to know that a raised loan doesn’t have to be repaid in a hurry, sometimes customers may want to have access to collateral before the loan is repaid.

In these cases, users can repay the loan using DAI, alUSD or a mixture of both.

You can also liquidate only a part of the loan.

This means that if you are missing $ 10 to repay a $ 100 loan, you will receive $ 90 of your deposit.

ALCHEMIX DAO AND ALCX

Like almost every blockchain project these days, the Alchemix team also has a DAO made up of the owner of ALCX, the governance of the Alchemix token.

The owners are protocol participants and community members.

Incentives for them to hold ALCX include:

- Staking ALCX

- Use of ALCX to participate in other liquidity pools on Curve, Sushiswap and Tokemark platforms

- They have the right to vote in the following areas, but not limited to:

- Operational issues related to DAO

- Distribution of treasury funds

- Grants to help ecosystem progress

- Submit proposals for consideration to the community

ALCHEMIX DAO TREASURY

The source of treasury revenue is 10% of the yields generated from the yDAI Yearn Treasury.

Part of that is used to pay for developer infrastructure costs. ALCX owners from DAO will vote for the rest of the funds.

ALCHEMIX TOKENOMICS

Unlike some DeFi projects that were launched with VC (Venture capital) funding, Alchemix was fully self-funded until its launch in March 2021, followed by a fair launch.

The token itself is designed to work best when most owners are also participants on the platform.

Although there is no fixed upper limit, current statistics from Coingecko.com show a maximum token quantity of 2,393,060 with a current amount of 1,248,748 tokens.

It is estimated that the first number will be achieved based on the initial issuance (pre-mine) of 478,612 tokens after 3 years.

From the initial amount:

- 15% goes to the DAO Treasury

- 5% are reserved for bug finder prizes

- 80% as a reward for staking

ALCHEMIX V2 CONTRACTS

V1 smart contracts do not interact with Alchemix vaults to prevent hacker attacks on them. However, it also limits what contracts can do.

For version V2, smart contracts have little interaction, but come with big limitations.

These V2 smart contracts were audited by Runtime Verification, a company specializing in smart contract auditing.

This was recently completed, in February 2022. Details of what the audit entails can be found at Runtime Verification.

ALCHEMIX RISKS

So far, the project seems to be pretty solid. However, there are always risks, and Alchemix is no exception.

In addition to interoperability comes reliance on other blockchain projects, so key areas of risk for Alchemix lie in other blockchains and its own smart contracts.

The risk of a smart contract

In October 2021, Alchemix suffered a “reverse rug”, with the yETH vault exploited resulting in debt repayment too quickly.

This resulted in a loss of $ 4 million and caused a quarrel in the team.

An additional V2 contract check was then carried out to prevent such incidents in the future.

This shows that the risk of a smart contract is very real, even with the best security measures.

CONCLUSION

The advantage of Alchemix is that it does not rely entirely on obtaining liquidity from the participants to keep the project going.

Through Yearn’s yDAI vault, the source of project revenue is less susceptible to manipulation by participants (whales or the project founders themselves).

Of course, there is always the risk that the founders will make some kind of rug pull, but also the crypto community believes that there are honest people who genuinely want to build something permanent that would, at the same time, benefit others.

As more and more DeFi projects begin to communicate and rely on each other, the possibility of cascading risk, or domino effect, is growing.

However, with enough projects supporting each other, it is also possible that what happens to one project may have minimal impact on others.

The way forward for everyone in the crypto space is the growth of this robustness so joint projects will be too big to fail.

This is not financial advice, the article presents a view of the current market situation. You are responsible for your own investments!

Fundamental and Technical Analysis in the Crypto World