Posted Mar 14, 2024r

The Impact of Bitcoin Halving: A Full Breakdown

Understanding Bitcoin Halving: A Complete Guide

Bitcoin halving is the moment when the reward for mining Bitcoin is reduced by half.

The halving happens every four years.

Bitcoin’s algorithm counters inflation by halving the number of Bitcoins mined periodically, keeping the total supply constant.

This is one of the most important events on the Bitcoin blockchain, if not the most important.

As of 2020, network participants who confirm transactions are awarded 6.25 Bitcoins (BTC) for each successfully mined block.

Next Bitcoin halving is on April 17, 2024, when the block reward will drop to 3,125 bitcoins (BTC) for each successfully mined block.

MEANING OF BITCOIN HALVING?

After the network has mined 210,000 blocks – roughly every four years – the reward awarded to Bitcoin miners for processing transactions is cut in half.

We call the event a “halving” because it reduces the rate at which new Bitcoins enter circulation.

Reward system will continue until around 2140, when we will reach the proposed limit of 21 million Bitcoins.

PREVIOUS BITCOIN HALVING DATES?

To this date, three halving’s have taken place:

November 2012 – reward reduced to 25 bitcoins

July 2016 – reward reduced to 12.5 bitcoins

May 2020- reward reduced to 6.25 bitcoins

Next one will be in April 2024.

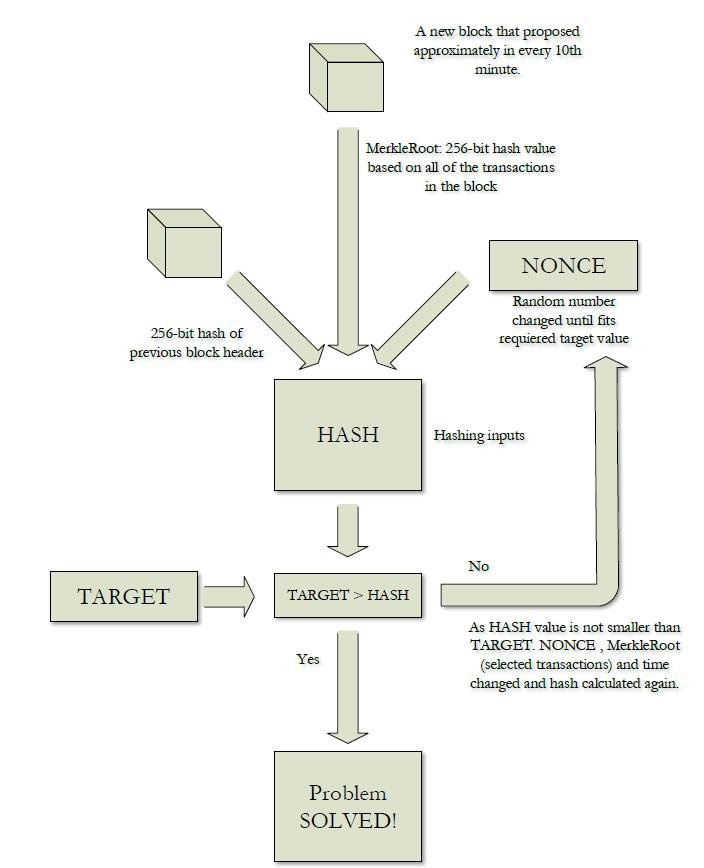

Bitcoin mining algorithm is set up with the goal of finding new blocks every 10 minutes.

Some blocks require more than 10 minutes, some less.

Operation like this can decrease or increase the time needed to reach the next halving target.

For example, if blocks are mined consecutively for an average of 9.66 minutes, it would take about 1,409 days to mine the 210,000 blocks needed (four years is 1,461 days, including one leap year day).

HOW PAST HALVING EVENTS AFFECTED THE PRICE OF BITCOIN?

Historically, there has been a fairly reliable pattern of growth and significant peaks in the price of Bitcoin after the halving.

Though past performance does not always guarantee future results, you can use this pattern to predict the price of Bitcoin if historical trends repeat themselves.

Although the effect of the halving on the price of Bitcoin can be disputed, it cannot be denied that so far each cycle has had a pattern that resembles the previous one.

Have in mind that, in addition to halving, the price of Bitcoin is also affected by various macroeconomic factors.

Those factors could be fluctuations in the money supply, interest rates, geopolitical events and current market sentiment.

Miners-Important Price Factor for Bitcoin Halving

A straightforward approach Bitcoin halving influences price is through supply and demand.

If fewer Bitcoins are available, the price should rise, assuming that demand remains constant or increases.

Additionally, miners only have half of the Bitcoins available for sale to cover their operating costs, reducing the overall selling pressure on the market.

Effect of the halving on the price of Bitcoin may be even more pronounced this time.

It is due to the fact that the demand could increase at the same time as the supply decreases, due to some important events in the crypto space.

But first, let’s look at how previous halving events have affected the price of Bitcoin, considering the price of Bitcoin in US dollars both at the time of the halving and at the peak of the cycle during the year that followed.

CONSEQUENCES THAT BITCOIN HALVING CAUSE IN THE PAST?

While it’s good to know that a raised loan doesn’t have to be repaid in a hurry, sometimes customers may want to have access to collateral before the loan is repaid.

In these cases, users can repay the loan using DAI, alUSD or a mixture of both.

You can also liquidate only a part of the loan. This means that if you are missing $ 10 to repay a $ 100 loan, you will receive $ 90 of your deposit.

Experts predict that the halving could lead to significant changes in the price of BTC, as was the case last time.

Nevertheless, factors such as global economic conditions, regulatory developments and strategies of institutional investors may affect the outcome.

Past Halvings and Bitcoin Price

During the 2012 halving, the price of Bitcoin rose from around $11 in November 2012 to around $1,100 in November 2013, resulting in a significant increase within a year.

Moreover,digital currency Bitcoin was still a relatively new concept during this period of time.

Furthermore, the market was primarily driven by small investors and early adopters who saw the potential of decentralized digital currency.

In contrast,the halving in 2016 saw the price of bitcoin rise from around $650 in July 2016 to nearly $20,000 in December 2017.

That growth was fueled by increased attention from major media and the entry of institutional investors.

However, regulatory developments and attempts to impose stricter rules on crypto exchanges have contributed to market volatility.

2020 halving saw the price of bitcoin rise from around $9,000 in May 2020 to an all-time high of around $69,000 in November 2021.

Large enterprises and investment funds entering the cryptocurrency market drove record institutional interest in Halving 2020.

COVID-19 pandemic has also played a significant role in shaping market sentiment.

Moreover,as the global economic crisis and unprecedented fiscal stimulus measures raised concerns about inflation and weakening national currencies, demand for Bitcoin grew.

Particularly,significant price growth before the halving, followed by a short correction and consolidation period before a large growth and a significant peak.

Interestingly,peak occurred approximately 18 months after the halving each time.

All this is a very simplified but accurate description of the last three cycles.

BTC HALVING 2024

Analyzing the historical patterns of Bitcoin halvings, it seems that investors often accumulate Bitcoins ahead of the halving and, indeed, precisely about a year before.

Observation like this would imply that, if we assume that the lowest price for this cycle was in November of last year (when Bitcoin hit a low of around $16,000), we are currently preparing for a new top that would, consequently, happen one year after the halving.

Such a theory is based on the belief that price movements follow a similar pattern to previous events.

Yet, it is important to know that it does not necessarily mean that there will be an increase or stagnation in the price of Bitcoin.

Crypto market has matured significantly since the last halving of 2020 and there are now far more cryptocurrencies that are at the forefront of users’ minds.

This is not financial advice, the article presents a view of the current market situation. You are responsible for your own investments!

Understanding the Fear and Greed Index in Crypto-The Most Important Ones