Posted May 06, 2024

FUNDAMENTAL AND TECHNICAL ANALYSIS IN THE CRYPTO WORLD

Fundamental and technical analysis in crypto world are two very important terms, moreover if we want to get closer to understand market trends in crypto, identify potential investment opportunities and avoid risks in the volatile cryptocurrency market by combining basic research and technical chart analysis.

WHAT IS FUNDAMENTAL ANALYSIS IN THE CRYPTO WORLD?

Also, this analytical method encompasses various aspects of the project and, in turn, evaluates its fundamental factors.

KEY ELEMENTS OF FUNDAMENTAL ANALYSIS

The team and the development team

Firstly,we analyze the quality and experience of the team behind the project.

Additionally,history and success of the team in previous projects is studied, as well as the evaluation of their expertise and skills necessary for the success of the project.

Technology and innovation

Next,we evaluate the technological infrastructure and innovations offered by the project.

For example,the technology concept, scalability, security, uniqueness and potential impact on industry or solving real problems are studied.

Business model and strategy

Finally,we analyze the project’s business model and its long-term sustainability.

This includes studying revenue sources, monetization strategies, market competition and potential advantages over other similar projects.

Market and competition

Size of the target market, the competition and the position of the project within the industry are examined.

Moreover,understanding the competitive advantage and positioning of a project can help assess long-term value.

Macroeconomic factors and regulation

Macroeconomic factors, regulatory trends, legal restrictions, geopolitical risks and other relevant factors that may affect the project are evaluated.

In addition, these factors play a significant role in determining the project’s sustainability and growth potential.

Partnerships and collaborations

Furthermore,the project’s partnerships, collaborations and connections with other successful projects or institutions are analyzed.

Ultimately this can provide additional security and opportunities for the project.

Social impact and community

Impact of the project on society and community engagement is studied.

Notably,an active and supportive community can be a positive indicator of a project’s long-term success.

Financial analysis

Specifically,an analysis of the project’s financial indicators is conducted, including total revenues, costs, profitability, financial stability and capital management.

Independent application of fundamental analysis can provide a deeper understanding of a crypto project and its underlying factors; however it is not necessarily sufficient to make a final investment decision.

Fundamental analysis often serves as the basis for estimating the value of a project, nevertheless, it should be supplemented with other analytical methods and factors.

TECHNICAL ANALYSIS IN CRYPTO AND WHAT IT REPRESENTS

Technical analysis in crypto in most cases is a method of studying historical prices, trading volumes and other market data in order to predict future price movements of cryptocurrencies.

It uses various tools and methods to analyze the market

KEY ELEMENTS OF TECHNICAL ANALYSIS

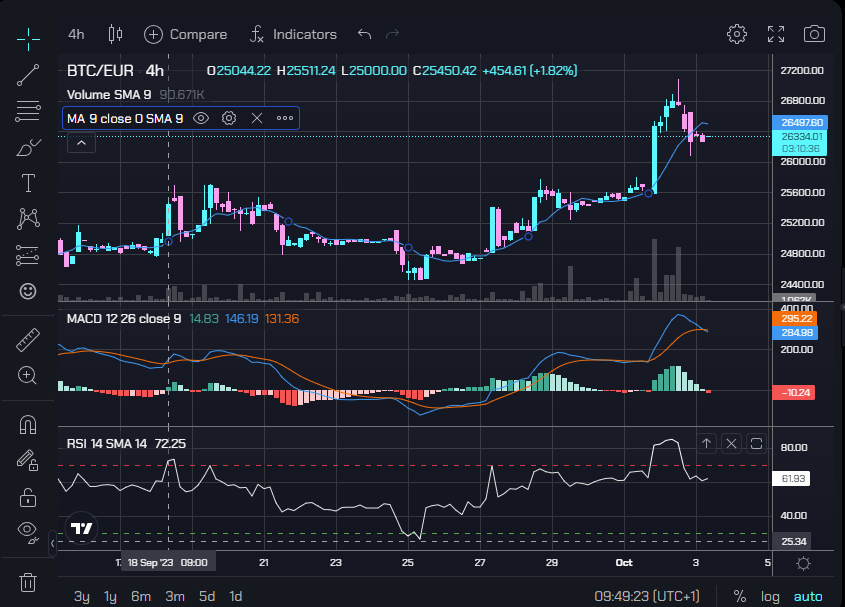

Charts

Charts are used, such as candlestick charts or lines, to visualize the movement of cryptocurrency prices over a period of time.

Besides they can show trends, reversals, support and resistance, and other important patterns.

Indicators

In addition,technical indicators are mathematical calculations based on prices and/or trading volume.

They help analysts identify trends, potential reversals, excessive conditions, or potential buy or sell signals.

For instance, examples include the moving average, relative strength (RSI), and the stochastic oscillator.

Candlestick Patterns

Professional analysis in crypto uses various candlestick patterns, such as “double tops”, “triple bottoms”, “engulfing candles” and many others, consequently, to identify possible reversals or continuations of trends.

Trends and support/resistance lines

It also identifies support lines (a level below which prices rarely fall) and resistance lines (a level above which prices rarely rise).

What’s more,these lines can help identify potential entry or exit points.

DOES TECHNICAL ANALYSIS HAVE ITS FLAWS?

Although technical analysis can provide useful information and guidance in evaluating the crypto market, it is important to be aware of its limitations.

Here are some downsides to consider if you rely solely on technical analysis to assess the crypto market:

The Unpredictability of External Factors

Focusing on the study of historical data and price movements is one of the important researches that technical analysis is doing.

However, cryptocurrency markets are exposed to the influence of many external factors, including news, regulatory changes, macroeconomic events, etc.

Consequently these factors can suddenly affect the market and reverse technical trends.

Lack of Fundamental Information

As has been noted technical analysis does not rely on fundamental information about crypto projects, such as fundamental values, technological innovations, competition, teams, etc.

information of this type can be crucial to the long-term value of a project; thus, it cannot be fully accounted for on the basis of technical analysis alone.

Interpretation of Subjectivity

In addition,interpretation of charts, indicators and patterns in technical analysis can be subjective.

Different analysts may have different views and interpretations of the same data.

Consequently this can lead to different results and trading decisions.

Information Lag

Technical analysis is based on historical data, and signals may take some time to appear on the charts.

This means that entering or exiting positions may be delayed, thereby missing out on optimal trading opportunities.

Unpredictability of the Market

Cryptocurrency markets are known for their high volatility and unpredictability.

In such environments, technical patterns and indicators may be less reliable, particularly because the market can react quickly to unexpected news or events.

Analoguos to that technical analysis is not without flaws and does not provide absolute predictions.

Cryptocurrency markets are highly volatile and subject to the influence of many factors, including news, regulatory changes and external events.

Therefore, combining technical analysis with fundamental analysis and general research can provide a more comprehensive approach to trading decisions in the crypto world.

This is not financial advice, the article presents a view of the current market situation. You are responsible for your own investments!

Understanding the Fear and Greed Index in Crypto-The Most Important Ones